“Nineteen states will increase their minimum wages on January 1, boosting earnings for more than 8.3 million workers by a total of $5 billion. In addition, 47 cities and counties will raise their minimum wages, adding to the number of workers likely to get larger paychecks because of lawmakers—or in some cases, voters—taking action to lift state and local wage floors.” EPI.org

My Happy New Year’s greeting is to those 19 states that increased their minimum wage, and my condolences to those Republican-run red states that haven’t ever increased their minimum wage but relied on the federal minimum wage of $7.25 per hour that was last increased in 2009.

Minimum wage hikes went into effect in 19 states on January 1, 2026: Arizona, California, Colorado, Connecticut, Hawaii, Maine, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, New York, Ohio, Rhode Island, South Dakota, Vermont, Virginia, and Washington.

Only four are Republican red states. The rest of the red states still have the federal minimum wage that is worth just $5.25 per hour in today’s dollars.

The advocacy group One Fair Wage (OFW) said “According to the MIT Living Wage Calculator, there is no county in the United States where a worker can afford to meet basic needs on less than $25 an hour. Even in the nation’s least expensive counties, a worker with one child would need at least $33 an hour to cover essentials like rent, food, childcare, and transportation.”

Yes, equality is good for everyone, but can this happen in this New Year 2026? We will have to move out of the second Gilded Age that Donald Trump is touting to support his tariffs that has enriched his robber barons.

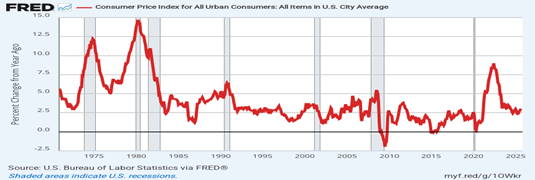

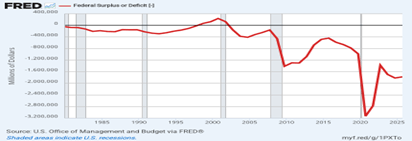

We know how we got here; the huge transfer of wealth beginning in the 1980s with massive Republican tax cuts that is obvious in this historical graph of budget deficits from 1980, when Big Business CEOs took over the running of our government.

Ronald Reagan’s Republicans created the first deficits beginning in 1980. The Clinton administration balanced the budget, creating a federal budget surplus in the years 1997 to 2000.

GW Bush then plunged US back into debt in 2000 with additional massive tax cuts while paying for the invasion of Iraq and Afghanistan. The annual deficits plunged further beginning in 2008 with the need to pay for the 2008-09 Great Recession (large gray bar).

Yet the Obama administration paid the annual deficit back down to its 2004 level. The Trump I era then increased it with more massive tax cuts being paid for once again by the American public. The graph portrays the obvious. The largest annual deficits were created during the years of Republican tax cuts.

More than $9 trillion will be added to the public debt in just the two Trump administrations from the renewal of the Trump tax cuts. So it is obvious that Republicans are mainly responsible for the $36 trillion public debt Americans are saddled with today that must be paid for to maintain the good faith and credit of the U.S. government.

Those tax cuts have benefited the few and lowered the living standard of many Americans, especially in those red states that haven’t raised their minimum wage. So it’s time to pay our enormous debt down that was created by those tax cuts. But that can only happen when enough Americans realize what has been stolen from them.

Can the tide begin to turn in this New Year, another Progressive era and a Teddy Roosevelt appear to end this Gilded Age of corruption? What will it take? Let us hope it won’t be another Great Depression to wake us out of our decline as a democracy.

May this be a Happier New Year!

Harlan Green © 2026

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen